You open the envelope from the hospital, and your stomach drops. The bill stares back at you, and a million thoughts run through your head at once. What?? That's a lot! Is that right? I can't afford that right now. Doesn't insurance cover it? Who can I talk to?

Is there something I should have done differently?

What if, next time, you were ready? Not because you could predict the expense, but because you had a plan.

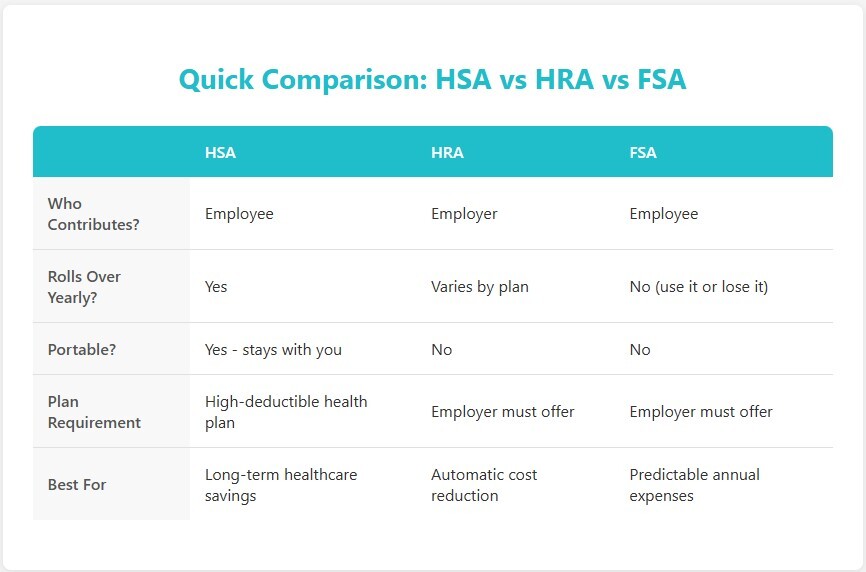

Healthcare Savings Accounts give you ways to handle medical costs strategically. Some are already funded and waiting for you to use. Others let you build reserves over time. The key is knowing which tools are available to you and how to put them to work.

Let's walk through your options, so the next medical bill doesn't catch you off guard.

Health Savings Account (HSA): Your Long-Term Healthcare Fund

How it works for you:

An HSA is available only if you're enrolled in a high-deductible health plan. These plans typically have higher annual deductibles and lower monthly premiums with a special savings account for health-related expenses. You’ll typically contribute a portion of your paycheck to the account tax-free (see triple tax advantage below), and the money is yours to keep forever.

In 2026, you can contribute up to $4,400 in total over the year if you're covering just yourself, or up to $8,750 if you're covering your family. If you're age 55 or older, you can contribute an additional $1,000. (Note: If both you and your spouse are 55+, you can each make catch-up contributions, but this requires separate HSAs.)

Here's what makes an HSA special: the money rolls over every year. It doesn't disappear if you don't use it. It stays with you even if you change churches, retire, or switch health plans. Think of it as a healthcare savings account that grows over time.

What you can pay for:

Your HSA dollars can cover a wide range of medical expenses:

- Health expenses count toward your deductible

- Copays and coinsurance amounts set by your plan

- Prescription medications (even some over-the-counter drugs)

- Dental and vision care, even if not insured by a health plan

- Medical supplies and equipment

- And much more (check the IRS qualified medical expenses list for the complete details)

The benefit: HSAs are often called the "triple tax advantage." Your contributions go in tax-free. Growth is tax-free, and withdrawals for qualified medical expenses come out tax-free. It even helps keep up with inflation since most accounts earn interest.

Best for: People who want to build long-term healthcare savings and are enrolled in a high-deductible health plan.

Health Reimbursement Account (HRA): Your Employer's Gift

How it works for you:

An HRA is funded entirely by your church or employer—you don't put any of your own money into it. The funds are simply there to help you pay for medical expenses. Your employer decides how much to contribute and which health plans include HRA benefits.

Unlike an HSA, you don't need to set anything up or make contribution decisions. Your employer has already taken care of it for you. Check with your benefits administrator to see if your plan includes an HRA and what your balance is.

What you can pay for:

Your HRA helps cover:

- Your plan deductible

- Coinsurance amounts after you meet your deductible

- Other eligible medical expenses as defined by your specific plan

The benefit: This account reduces your out-of-pocket costs automatically. When you have medical expenses, the HRA pays first—before you need to reach into your own pocket.

Best for: People whose employer offers HRA-compatible health plans. And also want employer-funded help with medical costs without making their own contributions.

Flexible Spending Account (FSA): For Predictable Expenses

How it works for you:

An FSA lets you set aside pre-tax dollars from your paycheck to pay for medical expenses. The catch? You need to use the money within the plan year. This is the "use it or lose it" rule—unused funds don't roll over to the next year.

What you can pay for:

FSAs work well for regular, predictable expenses like:

- Copays for doctor visits

- Prescription medications

- Medical supplies

- Dependent care (if you choose a dependent care FSA)

The benefit: You're paying for medical costs with pre-tax dollars, which reduces your taxable income.

Best for: People with ongoing, predictable medical expenses who are comfortable estimating what they'll spend for the year.

Which Account Is Right for Me?

Understand your options:

Step 1: Check your health plan. Are you enrolled in a high-deductible health plan? If yes, you can check your eligibility to use an HSA.

Step 2: Check if you're on a high-premium plan. If so, you may have access to an HRA.

Step 3: Think about your expenses. If you have more health care needs now, consider an FSA for flexibility. If you don’t have many concerns now, an HSA will help you save for the future.

Important note: You typically can't combine an HSA with an HRA, but you may be able to use an FSA with certain plans. Check with your insurer if you're unsure about your specific situation.

For Church Leaders: Supporting Your Staff with Healthcare Benefits

You're not just managing benefits—you're caring for the people who make your ministry possible. When your staff have access to the right healthcare savings tools, they can focus more on their calling and less on financial stress.

If you're responsible for setting up these benefits for your team, our guide on how to reimburse staff for church health insurance gives you the church leadership perspective. You'll find practical guidance on balancing wise stewardship with excellent staff support.

Your decisions about healthcare benefits directly impact your team's well-being. Whether you're helping your staff maximize their savings or designing a benefits package that serves your whole team well, you're doing important work.

Need Help Deciding?

RBA's personal advisors understand ministry families and the unique challenges you face. We're here to walk you through your options and help you make the choice that's right for your situation and your staff.

First, know which account matches your plan. Then check out our complete Benefits Guide to see contribution limits, eligible expenses, and step-by-step instructions for getting started.

[Download the 2026 Benefits Guide]

You can also explore our Healthcare Glossary if you want to understand terms like deductible, coinsurance, and qualified medical expenses.

You can make your healthcare dollars work harder and go farther, so you can focus on what matters most: your calling to ministry.

The information contained in this blog is for educational purposes only.